Friday, June 1, 2012

Continuous Improvement Software

5 Essentials for Successful ERP Implementation

Laying Plans for ERP Implementation

- Wisdom to understand the current and future operation process of the system, and the objective of the software and the future direction of the company.

- Sincerity in giving the best for the company

- Benevolence in getting everybody's view and ensuring no one is left behind or disadvantaged during the process

- Courage to make difficult decisions and choices when encountering problems and bottlenecks

- Strict in ensuring new policy and schedules are met

Tuesday, October 26, 2010

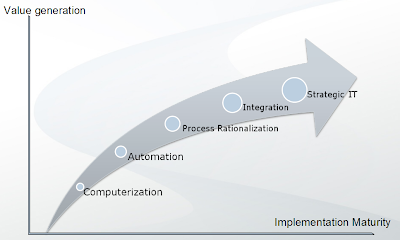

Evolution of IT Modernization

This article will explain the different stages of IT implementation maturity.

Computerization

The first transformation of a company to use IT is the replacement of paper process with data keyed into computer instead. This would immediately bring benefits of data now being able to be retrieved easily from the system, instead of inefficiency to do with paper. However, this is just the replacement of work from doing it on paper to be doing it in a computer instead.

Most companies have reached this stage of IT implementation, as they have their computers and standard software for their daily operations. They would be able to generate their reports and print their documents from the system.

Automation

When the company grows, they would find that with the company will face the same problem as before, that there is more and more work that needs to be done by the same headcount. Many companies who are not able to transform, would have to slow down their growth and expansion because of this issue. However, companies that brings their IT to the automation level will fly high.

By having IT automate the work of the staff, companies are able to gain more productivity from each employee. Things which computers are good at, should let computers to do, allowing employees to work on higher business level need of the company.

Automation tasks which IT should do are like commission calculation, where if manually staff is to do, would take days to generate. This saves not only manpower, but by opening up the commission to be daily commission, this boosts sales for salesman striving to meet sales target.

There are many processes which businesses can automate on. Do you see anything in your company which is manually done by your staff which you think IT can help in? Transform it to an automation program and reduce staff work!

Process Rationalization

Computerization and Automation would help centralize your business process and makes it faster. However, your business process is still just a migration from the previous paper-based process. Businesses needs to shift to the next paradigm of IT and Internet system and process. This level would be Process Rationalization of your business with IT.

Rationalized process would take advantage of IT to enhance your current process. If your normal process is for managers to sign off in all purchases, a rationalized process could be for the system to only show the managers purchases above certain amount that need his attention. If you have to look at a aging and post-dated cheque reports to find which customers to chase payment, a rationalized process would be for the system to find out and email out to you the customers that need your involvement.

In the rationalization process, the existing flow is optimized to remove unnecessary steps, and enhanced to add in more control to align closer to your business flow. When a business has reach this evolution, your business process would be unbinded from your paper trail, and more on data flow.

Integration

Now with your department already optimized to the new age of IT, the next phase of transformation for the company is to have an Integrated Process between the departments or with external parties. This reduces duplicate work done by different departments, and communications and aligning of data as well.

The most common data integration in the system is between inventory and accounting module. More complicated integration is between invoices and orders between companies within the same holding company. Instead of needing to key in both company accounts, this is automated and saves 2-4 times duplicate entries for the same document.

Bank Statement and Credit Card Reconciliation also takes a lot of manpower to be read when it's a paper-based statement sent to your company by the bank. Manually using the eye to view both results from the computer and the bank statement is prone to mistakes and is tedious for the accounting department. Computers can do the same logic again and again without being tired and complain, and with better result and accuracy. Integration your system with the bank's system output enhance your company productivity further.

Other integration includes EDI, and automated import / export functionality which saves manual process by clerks in a company

Strategic IT

The final step of IT transformation is for the company to be able to use IT to achieve Strategic IT advances. At this phase, the company would be able to make strategic decisions and benefits with information and recommendation provided by system and software.

Companies in retail use IT to transform their ordering process from manual centric calculation by buyers to an automated ordering system. The system would provide suggested order through product's pareto ratio, movement and sales trend calculation, allowing store operations to scale easily. Strategic reports like product ABC reports allow users to identify and take action only on the important items.

Managers of the company which has reached Strategic IT maturity are freed up to think about any company initiative, without thinking of constrains brought by manual process or IT system. IT in the company is matured into a level that it can support any new company plans for growth and expansion.

Final Words

With each IT maturity, it will bring a whole new set of IT benefits to the company. Which level do you think your company is in? How do you think IT can help you?

Xeersoft can lead IT transformation in your company. Please feel free to contact us at sales@xeersoft.com if you need more information.

Wednesday, July 21, 2010

Businesses need software…. Intelligent Software

Tuesday, April 13, 2010

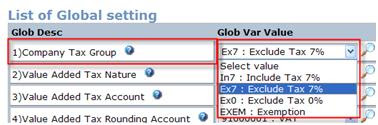

Is a VAT? Is a WHT? No… is a GST!

While the GST has been called to halt for the time being, what other surprises will businesses get in the near future?

Changes and policies

Government policies can change overnight, rates can be altered and more changes are affecting businesses in one way or another. Businesses have been using Information Technology (IT) to sustain business, build relationships, increase sales, manage commissions and even control employees. Changes like Goods and Services Tax (GST) or Value-Added Tax (VAT) and in some countries Withholding Tax, are but a small and insignificant addition.

Impact on Changes

However, the impact could be huge. Are your staffs prepared of these changes? How many memos, faxes, reminders, emails and broadcasts are going to be sent out just for one small insignificant change? Is your IT system prepared for the changes and what are the costs of upgrade? Any additional trainings to your employees after upgrading your software? All these need to be countered in.

The XeerSoft Factor

Whether is Withholding Tax, VAT or GST, XeerSoft has the experience in implementing these taxes in Singapore, Thailand and Vietnam. So, at XeerSoft, like it or not, we welcome GST as an opportunity to service our customers. No additional charges to upgrades and definitely no charges involved for extra trainings needed. Talk to us if you need to find out how XeerSoft services could assist your business by calling us at 03-9284 8286

Sunday, January 17, 2010

First Credit Monitoring Services for SMEs

Saturday January 16, 2010

SME Credit Bureau to launch country’s first Credit Monitoring Services for SMEs

By DALJIT DHESI

THE inception of the SME Credit Bureau Sdn Bhd in 2008 has given hope to credible small and medium enterprises (SMEs) seeking funds to expand their operations. At the same time, it has spared financial institutions the burden of screening trustworthy and reliable ones for financing.

The current internal credit rating system used by banks to assess SMEs takes only a micro view in the sense that it rates only SME customers without having a wider picture or other pertinent information on the SME market.

This is where the Bureau steps in. It offers SME credit risk rating, business review and business information reports to banks and SMEs.

The credit risk rating, according to chief executive officer Alex Lim, is carried out after getting the relevant information data of SMEs and later conducting credit rating specifically for each SME to facilitate financing. Information is extracted, among others, from the Companies Commission of Malaysia and Bank Negara.

“By using the default probability model we can gauge the likelihood of an SME’s ability to repay over the next 12 months. This is premised on their payment behaviour over the past 12 months.

Alex Lim ... ‘An effective CMS system will ensure that SMEs growth will not be hindered or affected by identity theft and fraud.’

“If they have been successful in making payments over the last 12 months then the probability of defaulting in payment is low and vice versa,” he tells StarBizWeek.

Another scale used in credit rating, he adds, is the percentile ranking which shows SMEs ability to pay relative to the entire SME universe. The higher the percentile ranking, the higher the SME’s ability to pay up the loan, he notes.

Having credible information and reliable data cuts down the bank’s processing time for applications of loans by average between 20% and 30%.

Having tied-up with US-based Dun & Bradstreet, he says, has enable the Bureau to localise and tap the expertise of its partner in credit ratings as the former has years of experience in the specialisation of solutions for credit bureaus worldwide. Dun & Bradstreet’s methodology has been used by credit bureau’s globally for more than two decades.

The Bureau at present has about 26,500 SME members fromover 500,000 SMEs in the country, and 38 member financial institutions. These include commercial banks, development financial institutions and Islamic banks.

SMEs wanting to be members must sign a contract with the Bureau. Based on the principal of reciprocity, they can only then access information if they provide authentic data to the Bureau.

Lim stresses that the Bureau does not provide any recommendations to extend or deny credit to SMEs, but rather aid them in building a track record and financial standing for facilitating funding.

He points out that the Bureau has spent millions to ensure that the data retrieved and stored is safe and not open to tampering or abuse. He says it will make significant investment over time in its bid to become a one-stop centre for credit information for financial institutions and SMEs.

To beef up its credit ratings and to curb fraud, the Bureau will launch on Feb 1 Malaysia’s first Credit Monitoring Services (CMS) for SMEs. Early this month, it introduced a similar service for financial institutions. The CMS system monitors key changes in banking and business information, trade credit information as well as credit ratings of SMEs.

These changes in data are then sent out as email alerts to SMEs who subscribe to the service.

By alerting them, Lim says the CMS can prevent fraud and identity theft as well as any discrepancies or changes to their credit information.

Identity theft occurs, for example, if an SME’s identity is used illegally to apply for credit, and changes to credit information occur when there is new loan applications, enquiries by financial institutions, and other credit guarantors and utilities related updates.

Apart from receiving email alerts upon changes of their information in the Bureau’s database, SMEs may also purchase the self enquiry report separately if more detailed information is required, he noted. A nominal fee of RM50 per year will be imposed on SMEs that wish to subscribe for the service.

“An effective CMS system will ensure that SMEs growth will not be hindered or affected by identity theft and fraud. It also ensures their business registry and credit information are kept updated and accurate to ensure their applications for financing will not be jeopardised by inaccurate or out dated credit information,” Lim says, adding that CMS will promote good credit culture among SMEs, which will ultimately lead to more credit facilities in less time.

Source: The Star Business